Overview

The accounting treatment for internal-use software costs can be confusing. Amidst the growing number of software applications moving to subscription-based cloud solutions, it is important to understand the accounting treatment of the arrangement. Also, certain costs related to software that is 1) obtained or developed for internal-use, 2) sold, leased, or marketed, and 3) used in connection with Cloud Computing Arrangement (“CCA”), can be capitalized. Specific accounting guidance and criteria exist to address which of these costs can be capitalized. In this whitepaper, we will be focusing in how to appropriately account for a CCA and the capitalization criteria for costs incurred in connection with the CCA.

Key Terms

CCA – includes Software-as-a-Service (“SaaS”), Platform-as-a-Service (“PaaS”), Infrastructure-as-a-Service (“IaaS”), and other hosting arrangements.

SaaS – includes a wide range of arrangements providing web-based delivery of applications managed by a third-party vendor.

PaaS – involves a third party providing a framework a team of software developers to create and manage customized applications.

IaaS – involves a third party providing on-demand, self-service access to highly scalable and automated computing resources, including monitoring, networking, storage, and other services.

Hosting–refers to situations in which the end user does not take possession of the software; instead, the software resides on the vendor’s or a third party’s hardware, and the customer accesses the software remotely.

Timeline

In April 2015, the FASB issued ASU 2015-05 on a customer’s accounting for fees paid in a CCA. Under the guidance, customers would apply the same criteria as vendors to determine whether a CCA contains a software license or is solely a service contract. This guidance helped companies in evaluating the accounting for fees paid in a CCA, by distinguishing between arrangements that include a software license and arrangements that are solely a hosted CCA service. However, the guidance did not specifically address how to account for implementation costs.

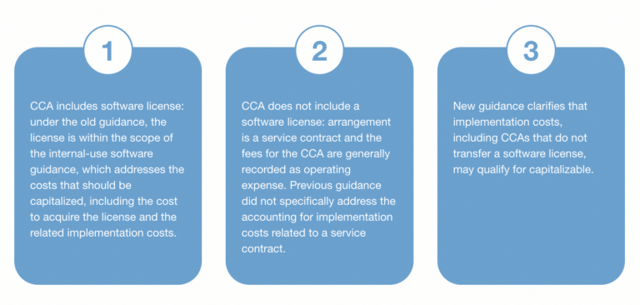

In August 2018, the FASB issued ASU 2018-15, which amends the current guidance for CCAs by providing explicit accounting for implementation costs of a hosting arrangement that is a service contract. The amendments effectively align the accounting for implementation costs for hosting arrangements, regardless of whether they convey a license to the hosted software. Thus, a hosting arrangement that is a service contract will follow the guidance in ASC 350-40, to determine which implementation costs to capitalize or expense. The illustration below depicts how the new accounting works.

-

CCA includes software license: under the old guidance, the license is within the scope of the internal-use software guidance, which addresses the costs that should be capitalized, including the cost to acquire the license and the related implementation costs.

-

CCA does not include a software license: arrangement is a service contract and the fees for the CCA are generally recorded as operating expense. Previous guidance did not specifically address the accounting for implementation costs related to a service contract.

-

New guidance clarifies that implementation costs, including CCAs that do not transfer a software license, may qualify for capitalizable.

In determining capitalizable costs, the internal-use software guidance focuses on the stage of the project in which the costs are incurred. However, implementation of a hosted CCA service is a process that may not occur linearly. Therefore, an assessment as to the nature of the costs incurred (i.e. implementation costs versus training costs or re-engineering costs), not solely the timing, should be performed to determine if costs are capitalizable.

Companies should be assessing arrangements with CCA service providers to determine the fees that represent implementation costs. With some arrangements, the CCA service provider may not separate the fees for implementation services from the fees for the hosted CCA service. In such instances, there may be a single monthly payment stream for all services. When this occurs, the company will need to estimate the portion of the fee that relates to the implementation services to apply the guidance under ASU 2018-15 to these costs.

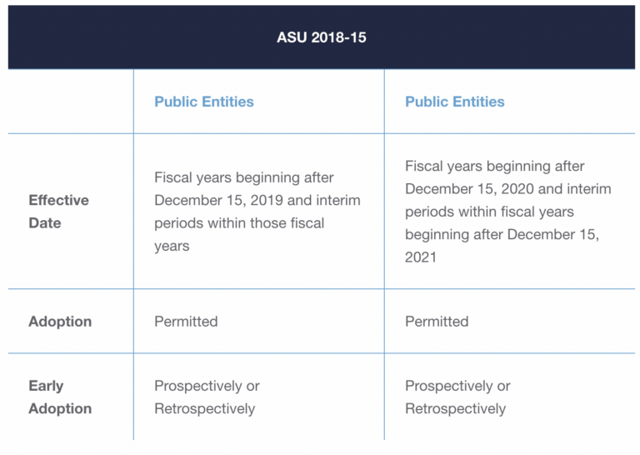

Companies electing to adopt prospectively would apply ASU 2018-15 to eligible costs incurred on or after the date the guidance is first applied. Both prospective and retrospective adoption requires companies to disclose the nature of and reason for the change in accounting principle, the transition method elected, and a qualitative description of the financial statement line items affected by the change. Under the retrospective transition approach, an additional disclosure providing quantitative information about the effects of the change is also required.

Management Consideration – Does the company have experience implementing cloud platforms and solutions?

Applying the Cloud Computing Guidance and Financial Reporting Impact

The first step is to determine whether the CCA will be accounted for under the internal-use software guidance, ASC 350-40. This assessment could have a significant impact on financial reporting, which will be explained further below. The cloud computing guidance in ASC 350-40 only applies if 1) the customer has the ability to take possession of the software without a significant penalty and 2) it is feasible for the customer to run the software on its own systems or another third party’s system (ASC 350-40-15-4A). Arrangements that meet the CCA criteria are considered multiple-element arrangements to purchase both a software license and a service of hosting the software. Existing guidance on accounting for costs associated with software intended for internal-use would be applied to the purchased license. If both criteria are not met, the arrangement is considered a service contract, and separate accounting for a license is not permitted.

Management Consideration – In evaluating a CCA, businesses must determine whether they software license and arrangements that are solely a hosted CCA service. Oftentimes, service providers have agreements that fit under both models. In such instances, it is important for management to have the agreements evaluated prior to the execution of the contract to obtain the preferred accounting treatment.

Costs incurred by a customer in a CCA that include a software license should be allocated between the license and hosting elements. The consideration should be allocated based on the relative fair value of each element. Determining the fair value of the software license and hosting service may require the use of estimates. Management should consider all relevant information, such as information from the negotiation process with the vendor, in estimating the fair value of the license.

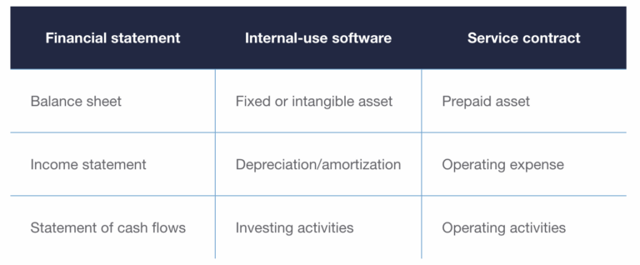

The accounting impact for an upfront fee paid in a CCA differs depending on whether the fees are considered a payment for a software license or a prepayment for a service contract, as shown in the illustration below.

Determining CCA Costs That Can Be Capitalized

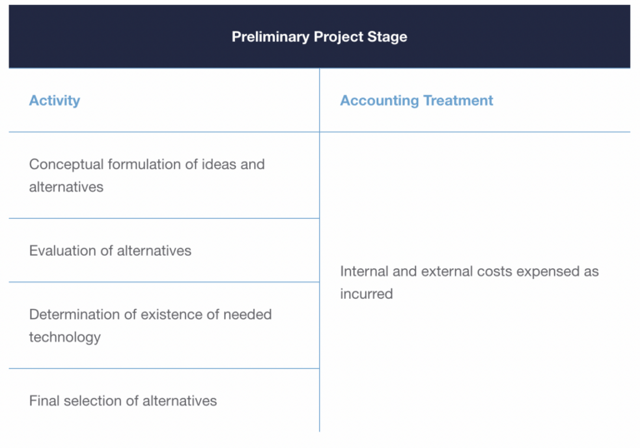

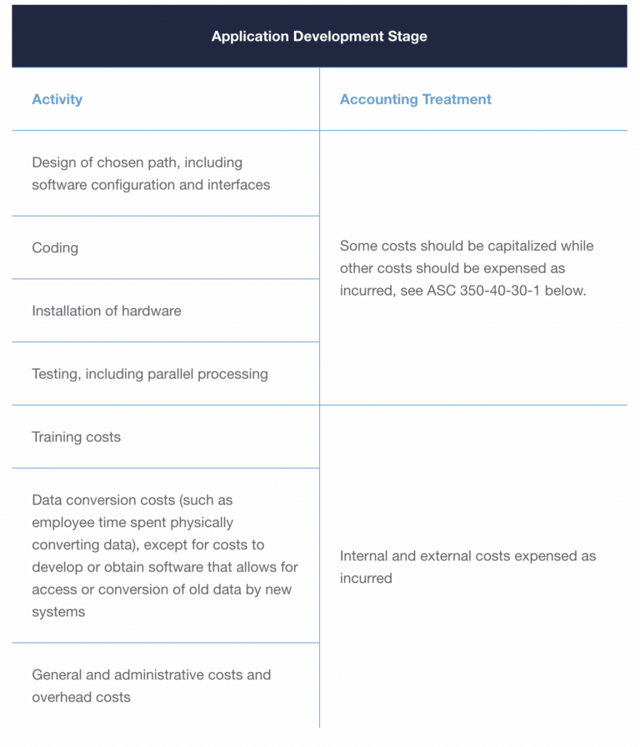

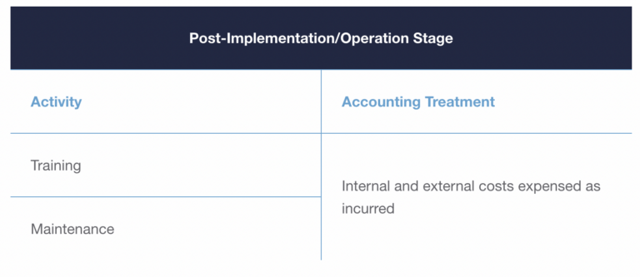

Once a determination has been made over the appropriate accounting treatment of a CCA, the next step is to determine the costs that can be capitalized. To perform this assessment, an understanding of the stages of development for internal-use software is necessary. ASC 350-40 divides the development into three stages 1) preliminary project, 2) application development, and 3) post-implementation/operation. Only certain costs falling within the application development stage are capitalizable. Shown below is the accounting treatment for the three stages of development and example activities falling within the scope of each.

Management Consideration – Can the company handle the data, controls and processes during both implementation and post-implementation?

ASC 350-40-30-1 specifies the types of costs that can be capitalized within the application development stage. Costs of computer software developed or obtained for internal use that shall be capitalized include only the following:

- External direct costs of materials and services consumed in developing or obtaining internal-use computer software. Examples of those costs include but are not limited to the following:

- Fees paid to third parties for services provided to develop the software during the application development stage.

- Costs incurred to obtain computer software from third parties.

- Travel expenses incurred by employees in their duties directly associated with developing software.

- Payroll and payroll-related costs (for example, costs of employee benefits) for employees who are directly associated with and who devote time to the internal-use computer software project, to the extent of the time spent directly on the project. Examples of employee activities include coding and testing during the application development stage.

- Interest costs incurred while developing internal-use computer software. Interest shall be capitalized in accordance with the provisions of Subtopic 835-20.

In summary, costs that are directly correlated to the actual development of the software application should be capitalized while indirect costs related to the software development (i.e., data conversion, G&A, overhead) should be expensed as incurred during the application development stage.

Management Consideration – Does your company have the in-house technical expertise to appropriately identify capitalizable implementation costs? Are external service providers including clear descriptions of the activities they are performing for the company to evaluate? Are employees working on the project reporting their time and the associated activities?

Capitalization

Capitalization of qualifying costs during the application development stage should begin when both of the following occur:

- The preliminary project phase is completed, and

- Management, with the relevant authority, implicitly or explicitly authorizes and commits to funding a computer software project and it is probable that the project will be completed, and the software will be used to perform the function intended (i.e., execution of a contract with a third party, approval of expenditures related to internal development, or a commitment to obtain software from a third party).

Capitalization should stop no later than the point at which a computer software project is substantially completed and ready for its intended use. Computer software is ready for its intended use after all substantial testing is completed.

Amortization of Capitalized Costs

The amortization of capitalized costs will differ between CCAs which qualify to be accounted for under the internal-use software guidance and those that do not. CCAs accounted for under the internal-use software guidance are amortized on a straight-line basis (unless another systematic and rational basis is more representative of the software’s use) over the estimated useful life of the software. The amortization recorded is classified within the income statement as depreciation/amortization expense.

In determining the appropriate life, ASC 350-40-35-5 provides the factors that should be considered a) obsolescence, b) technology, c) competition, d) other economic factors, and e) rapid changes that may be occurring in the development of software products, software operating systems, or computer hardware and whether management intends to replace any technologically inferior software or hardware. Given the history of rapid changes in technology, software often has had a relatively short useful life. Also, amortization of software obtained or developed for internal-use should begin when the software is ready for its intended use, regardless of whether the software has actually been placed in service.

Capitalized costs for CCAs determined to be service contracts represent any amounts prepaid under the provisions of the agreement, and capitalizable implementation costs. These amounts are then expensed on a straight-line basis (unless another systematic and rational basis is more representative of the software’s use) over the term of the agreement and classified as operating expense within the income statement.

Software Upgrades and Enhancements

In contrast to maintenance costs during the post implementation/operations stage, which are expensed as incurred, the accounting for specified upgrades and enhancements to internal-use software should follow the same accounting model as that used for new internal-use software (i.e. qualifying costs for the upgrade/enhancement should be capitalized during the application development stage), provided it is probable that the expenditures will result in additional functionality. Additional functionality means that the software modifications enable the software to perform tasks that it previously was not capable of performing. ASC 350-40-25-10 indicates that if a company cannot separate costs on a reasonable basis between maintenance and relatively minor upgrades and enhancements, the costs should be expensed as incurred.

Tax Impact of CCA Costs

The new cloud computing guidance creates an opportunity to enhance tax processes and increase tax positions around these costs. As the nature of the CCA costs incurred will dictate treatment for both tax and book purposes, ASU 2018-15 can also be an opportunity to create synergies related to data gathering around such positions. Key tax areas of analysis include:

- Section 174 – The ability to currently deduct or amortize software development and research and experimentation expenses (prior to tax year 2022) related to the implementation of systems, solutions, applications, and middleware related to cloud computing should be evaluated. From 2022 onward, all Section 174 expenses are capitalized irrespective of the nature of the costs incurred.

- Section 41 Research & Development Tax Credit – Software development efforts related to cloud computing applications, solutions, and middleware, as well as the implementation of the cloud computing standard into the customer’s financial systems, should be analyzed for eligibility for the Research & Development Tax Credit, which could result in permanent tax savings.

- Capitalization – As a result of tax reform, if costs are capitalizable for tax purposes and qualified for 100% bonus depreciation, customers can immediately expense these costs. If certain CCA costs are associated with a lease, this would also have tax implications.

- Management Consideration – An analysis of the tax impact from this change in accounting should be performed as well as how tax positions can be improved.

Final Thoughts

The accounting treatment for CCAs can be challenging. The first challenge is in determining whether a CCA should be accounted for under the internal-use software guidance (ASC 350-40) or as a service contract. This requires determining whether the two criteria stipulated within the guidance have been met. Only CCAs that have met both criteria can the internal-use software guidance be applied. In addition, the outcome of this decision can have a significant impact to financial statements resulting from differences in classification within the balance sheet, income statement, and statement of cash flows.

Once a conclusion has been reached, the next difficulty becomes identifying the costs that qualify for capital treatment. Understanding the three stages of development and the activities within each will dictate capital treatment. The illustrations previously shown identify the three stages and types of activities falling within each.

The summation of all conclusions and positions taken, should be clearly articulated in a technical accounting paper. Documentation for amounts being capitalized should also be maintained as evidential audit support. For any third-party service providers, it may be necessary to request that they itemize their invoices to show the stage of development and activity for which services are being billed.

Our teams can assist you during both the evaluation and implementation of CCAs, as well as in understanding the accounting and financial reporting impact. Contact us to discuss how we can help in:

- Implementing cloud platforms and solutions;

- Accounting analysis of the CCA;

- Handling of the data, controls, and processes during implementation and post-implementation;

- Accounting analysis of capitalizable implementation costs;

- Analysis of tax impact and how tax positions can be improved; and

- Financial reporting and disclosures stemming from change in accounting.

At Eliassen Group, we have a unique combination of expertise where accounting, risk, and information technology intersect. We help to simply complex accounting and reporting challenges, while driving operational efficiencies in your organization. We provide the highest level of service to our clients.